free binary options candlestick charts

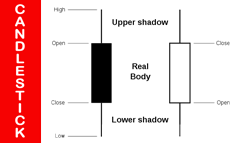

Most binary choice traders utilise Japanese candlestick charts for technical analysis. Some choose to trade using tick charts but in most cases information technology's the 300 twelvemonth-old candlestick chart organisation that is still in use today.

The closest thing to the actual price is the price data itself and the candlestick chart represents current cost data and its direct supply and need dynamics which translates into investors' mind-set.

The candlestick formations illustrated below are peculiarly helpful in trading binary options because they signal an upcoming correction or a alter of trend.

1. The Doji

The length of a Doji may very but a perfect 1 would be with the same opening and endmost price, so visually every bit sparse equally a sparse line. If a Doji appears in a sideways market place it is insignificant just if information technology appears lonely and at the summit of a trend, a watchful binary options trader should take notice and prepare for a sudden possible reversal. If you're using Bollinger Bands and the price action is touching or beyond the bands the presence of a Doji may point a quick correction or a trend alter. The Doji can appear in the bullish and surly markets. The picture illustrates a Doji that could as well be seen as a Spinning Pinnacle, just both candles signify market indecision. Download a Doji Indicator for MT4

2. The Dragonfly Doji

The appearance of a Dragonfly Doji candle at the finish of a downtrend is very bullish. Information technology basically shows that the sellers were able to bulldoze the toll lower but were unable to sustain the downwardly cost motility considering the cost closed at the aforementioned amount information technology opened. This may indicate an upcoming bullish motion and quite possibly a strong upward trend. The indicate marked past a Dragonfly Doij can exist much stronger when it touches back up resistance lines or Fibonacci retracement lines.

3. The Gravestone Doji

If the upper shadow is very long it means the sentiment is bearish. What happens during the defined fourth dimension of the candle is prices open up and merchandise high and then return to the opening cost. This type of movement shows that investors rallied but failed to attain a higher price. This shows a surly sentiment and if this candle formation is seen touching resistance lines, or Bollinger bands or Fibonacci levels, than it may point an upcoming reversal. Download Fibonacci Doji/Pin bar MT4 Indicator

four. The Hammer

This blueprint has a pocket-size real body and a long lower shadow which must be at least twice the length of the torso. Hammers appear in the downtrend market place and they derive their proper name from trying to 'hammer out the bottom' of the trend. A Hammer shows that buyers, despite the surly sentiment, were able to push the prices higher than the opening cost. This failure of the sellers reduces the surly sentiment and may signal a trend reversal.

Do you need an piece of cake to follow and very assisting candlestick strategy? Download The Candlestick Trading Bible

v. The Hanging Man

The Hanging Man is essentially The Hammer but it appears at the top of a trend or in an uptrend. In order for the Hanging Human being to course the price activity must trade much lower than the opening toll and so rally to shut near the high. This forms long lower shadow and may point that the market will begin a selloff and a possible reversal will start soon. The Hanging Man with a black or red (depending on your candlestick configurations) real body is more bearish than one with a total or green body.

six. The Belt Hold – Bullish & Surly

A Chugalug Hold consists of two real bodies of opposite colour. Information technology forms when the market is trending and a pregnant gap occurs in the direction of the trend on the open simply the trend reverses and the candle goes into the reverse direction, Bullish Belt Hold or Bearish Belt Hold, sometimes engulfing the previous candle and changing the trend. The Belt Hold candle formation signifies a modify of investor's listen set up and is a sign of a possible reversal and trend modify.

seven. The Harami Patterns

The Harami pattern can be bullish or bearish and is similar to the Belt Concur. It also consists of two candles with real bodies of opposite color but the open price of the 2d candle is within the close toll of the previous candle. The second candle, although it closes in the opposite direction information technology does not engulf the previous candle entirely as in The Chugalug Hold. A lack of upper shadow (in downward trend) or lower shadow (in upward trend) of the 2nd candle indicates a stronger trend.

Decision

The are many more than candlestick patters that we will examine in other lessons simply these are skillful to watch out for when you trade binary options.

Knowing how to read candle stick price patterns will also be helpful in confirming binary options signals, should you lot decide to utilize them.

It'southward important to understand that candlestick patterns accept a college success rate on upper time frames, 4H and upwardly. They can besides be considered on the 5 or 15 minute charts, but one minute candlestick formations might not be reliable.

Visit Forex Candlesticks Fabricated Like shooting fish in a barrel

Candlestick charts piece of work well on their own and if y'all learn to read them well, you volition sympathize certain marketplace sentiments that will definitely improve your trading.

Information technology is appropriate to view candlestick charts with Bollinger Bands (moving Averages) and/or other indicators. Using as well many technical indicators can be very distracting. It's best to focus on price action and then confirm it with maximum two-iii other indicators and volumes.

Master your trading skills with the The Candlestick Bible that reveals in detail the candlestick trading techniques used professional and successful traders.

Source: https://winatbinaryoptions.com/7-candlestick-formations-every-binary-options-trader-must-know/

Posted by: reedcraver1962.blogspot.com

0 Response to "free binary options candlestick charts"

Post a Comment