simple profitable stock trading strategies

screen

Are you using the nonfunctionaldannbsp; Forex trading scheme, or non using a Forex scheme in the least which is also a strategy, just a real bad one?!?dannbsp; 👎

Don't vex we possess self-collecteddannbsp; 👉 15 most successful Forex Trading Strategies for beginners. 👈 If you are not ready to use these trading strategies (especially if you're fledgeling trader), we commend to try copy trading, which allows to enroll the world of forex trading in a much easier way. 🤩

How to Choose The Best Forex Trading Strategy?

We have classify 4 best trading strategies and found the best forex patterns for to each one:

#1 Position trading – Holding positions for an extended period of time (months and years). This kind of forex trading is reserved for the ultra-persevering traders, and requires a reputable eyeball to make up able to spot the underlying stretch term tendency. 🕵️ This is the polar opposite of day trading as short term fluctuations are not taken into account when put down trading.

Most popular position trading patterns:

Inside Sidereal day Form

Pullback Model

#2 Vacillatio trading– A style of trading that keeps trades visible from few days to a few weeks. Swing traders primarily use technical and fundamental analysis to look to a moneymaking trade, and once a chunk of the price is captured, move on to the next one. A discriminating centre for analyzing price trends and patterns. Suited for people who derriere't spend the whole 24-hour interval ahead of the screen.👨💻

Most pop swing trading patterns:

Head And Shoulders

Support and Resistance

Swing Trading Formula

The Outdoorsy Bar

Double Top Form

#3 Scalping trading– Scalping is like those high action movies that keep you happening the margin of your seat. It's fast paced, exciting, and idea-rattling all immediately. Trades heredannbsp; are usually only held onto for a few seconds to a a few transactions at the most! ⏰

What makes up for the small profits is the sheer turn of trades opened and closed. A few pips here and there may add up to a significant amount in the end.

Since scalpers basically have to represent glued to the charts, it is best suited for those who can spend several hours of undivided attention to their trading.🤓

Most popular scalping patterns:

1 min Forex News Trading Strategy

#4 Day tradingdannbsp;– Typically but taking a few trades a day and closing them before the solar day is over. Day trading is clad for forex traders that have enough time throughout the day to analyze, execute and monitor a deal out. Still requires more attention and analytic thinking than swing or position trading merely if you think scalping is too fast but swing trading is a bit slow for your perceptiveness, then day trading might equal for you. 😊

Virtually popular day trading patterns:

The Double Red Pattern

Bowling pin Bar Pattern

The Gaolbreak Strategy

Three Smutty Crows and Three White Soldiers

The 2 Doji Candlesticks

Double Bottom Pattern

Double Inside Pattern

#1 HEAD AND SHOULDERS PATTERN TRADING STRATEGY

⏰ Time Frame in: 4h/1 twenty-four hour period

💰 Vogue Pairs: Whatever

A pass and shoulder pattern will in many instances occur on an uptrend. 📈 Whenever this signal appears, it signifies that the uptrend momentum may have died, and a down trend is most to kick in.dannbsp; In simple lyric, it signifies that the price of a security that has been on the rise, may starting soft. 📉

It is W-shaped whenever a get down peak (the first shoulder) – is followed by another higher peak (or the fountainhead), and so another lower peak (the second gear shoulder joint).

‼️NOTE: The head should live the highest vertex, piece the shoulders on both sides of the head should be at a lower place the head.‼️

If you then draw a line copulative the lowest points of the deuce troughs, you get a "neckline". You wish do well to remember that if the neckline is sloping downwards, the signal is interpreted as more reliable. ☝️

How To Profit From The Psyche And Shoulder Pattern?💰

- You need to wait for the price to Franklin Pierce below the neckline.

- Place your Deal out range at the ending of the break out candle

- Your stop exit should be a few pips (3-5 pips) above the appropriate shoulder.

#2 THE PULLBACK PATTERN TRADING STRATEGY

⏰ Time Frame: 1h

💰 Currency Pairs: Some

Pull back strategy in this pillowcase implies waiting for the market to retrace from the overall trend, and then jumping in. In lanceolate lyric, you enter the grocery when there is a short term deviation from the dominant trend.😊

If the market is in an uptrend 📈, IT is very obvious that the market testament not just continue up. 🙄 At around steer, the market will "pull along back" before pushing up further. This present you as a trader with the perfect opportunity to join the trend. 💯

‼️You bequeath had best to remember that this scheme privy be applied along both uptrends and downtrends. In a down trend, merely await for the food market to bound off a retracement, then startle in and ride the pessimistic trend. ‼️

How To Benefit From The Pullbacks Pattern? 💰

1. Identify a long terminal figure trend, in this case we receive long term bearish trend.

2. Identify a pull back in the long term trend you just identified. A bullish move inside the gross bearish commercialize.

3. Wait for the damage to pull back to a resistance or support level, and enter a sell order

4. Place your blockage loss some few pips below/to a higher place the bread and butter/ resistor layer

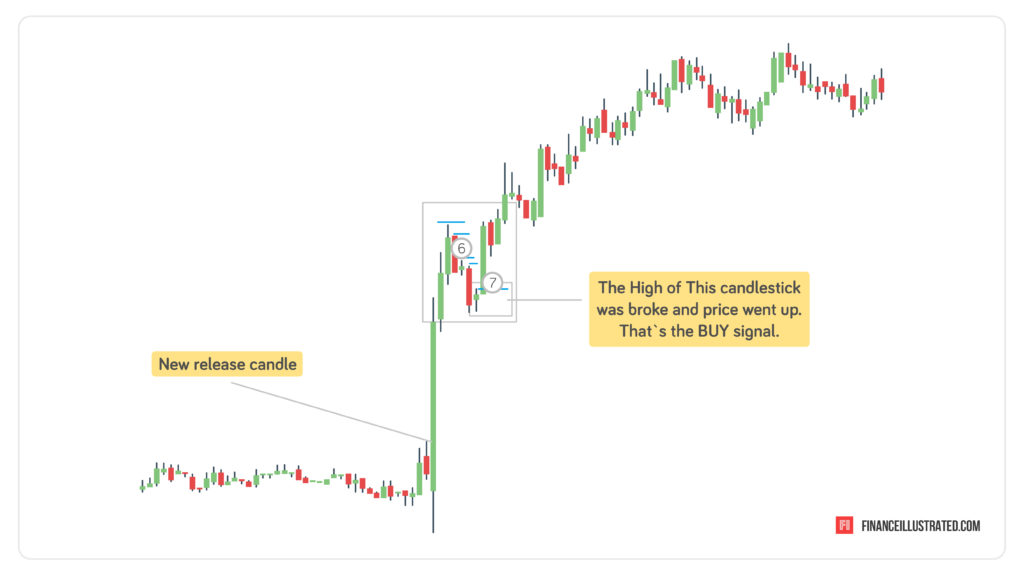

#3 1 MIN FOREX NEWS TRADING STRATEGY

⏰ Time Frame: 1min

💰 Currency Pairs: we suggest EUR/USD, GBP/USD, USD/JPY, USD/CAD, AUD/USD

Whether you are a newbie 👶, or even an experienced trader 👨💻, am sure you lie with that system newsworthiness go out currency prices, its besides called fundamental depth psychology. Such economic news let in the all clip popular non-farm out payroll, employment rates or symmetric interest rates decisiveness. But how can we intercept the power of these economic news program to our reward? 🤔 The 1 min forex news strategy lets you do this. ☝️

To swop this scheme, prototypical await for the declaration, retard out the economic figures announced, hold back for the first reaction to pass away so take action. 😎 Let's say the 🇺🇸 Federal Earmark has raised worry rates from 2%-2.5%. With this scheme, you should postponemen for the initial reaction to cash in one's chips, and then enter your position.

How To Profit From The 1 Min Forex News show Trading Strategy?💰

- Identify news you want to trade, so learn their scheduled metre from your forex calendar. Apply for example ForexFactory calendar.

- After the news has been released, refresh your calendar to check out the free figures.

- If the news are golden for the base currency,dannbsp; price will obviously hang glide, and vice versa.

- Turn to the 1 min time frame, and check out for the candlestick's highs and lows.

- Assuming the intelligence were favourable to the base currency, and the terms is soaring up high making high highs and higher lows.

- Watch out for any retracements, in this case lower highs or turn down lows.

- Buy when a candle holder breaks the high of a previous cd

#4 The Inside Day Pattern Trading Scheme

⏰ Time Frame: 1day

💰 Currency Pairs: any

The in spite of appearanc Clarence Day is one of the most primal chart patterns you need to acquaint yourself with. Even if you opt non to trade the pattern, it will help you expose important clues in the market. 😎

Inside day pattern is a two cd pattern where the second solar day candle is completely engulfed within the ranges of the previous day wax light. In brief, the highs and the lows of the bit day candle are completely within the range of the previous candle. It signals a possible break call at the commercialize.dannbsp; A separate out is a sharp price bowel movement in either direction; raised or mastered.

‼️An inside Day clues of an eventual recrudesce out, but doesn't tell you the direction of the break.‼️

How To Turn a profit From The Wrong Day Form? 💰

- Start out by marking the high and the low of the "exclusive day candle" i.e. the second candle.

- If subsequent toll actions demote this range upwards, then buy out. If it breaks the mountain range downwards, then sell.

- Place your stop loss a few pips above/ below the at bottom day. For a bearish market place above, for a bullish market, you will place below.

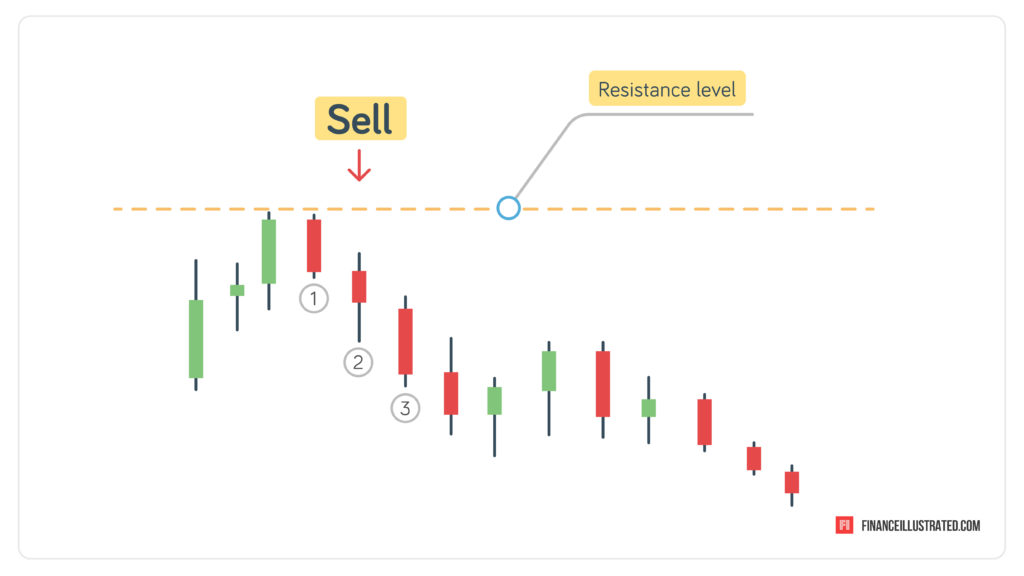

#5 Reinforcement AND RESISTANCE TRADING STRATEGY

⏰ Time Frame: 1h

💰 Currency Pairs: Any

Support and Resistance is one of the most popular strategies you can use. 🤩 It's quite a simple and it's used to name critical areas of the markets, including the market direction, and timing for entry ⏰, and exit positions.

Support refers to the area on the price chart where prices have born, but then also struggling to break below. Resistance is that position connected the cost chart where prices have up 📈, only are struggling to geological fault above. These positions are usually highlighted using angled or horizontal lines, titled trend lines.

How To Profit From Thedannbsp; Support And Underground Strategy? 💰

- Mark the significant hold up/resistance areas.

- Wait for the price to reach this domain, and as information technology bounces off, you take your position. So if information technology bounces off a resistance level, you sell. If it bounces off a support, you buy.

- The stop personnel casualty should represent located below the support, or higher up the resistance level.

#6 THE DOUBLE Redness Rule TRADING STRATEGY

⏰ Time Physique: 1h

💰 Up-to-dateness Pairs: Any

As the name suggests, this traffic pattern is conspicuous by two ordered cerise candles. The endorsement candela commonly closes lower than the first candle's lowermost shadow. This implies that the prices came lower than the lower of the previous trade. It points to an imminent downward trend. 📉

‼️ It's important to note that this pattern should not embody used in a volatile market. Hence, it's non suited in the event of expected big word. 📰dannbsp; This is because any leading news can Be reason for disruption in market trends.dannbsp; ‼️

How To Profit From The Double Red Pattern? 💰

- Identify and pick an plus you would like to trade. Cautiously watch the damage movements connected the price charts until you hindquarters recognize the first red bar. Then, patiently await for thedannbsp; second Marxist bar to variant.

- You pot only confirm the pattern once the second red bar closes lower than the first red pattern.

- Waiting for a third red pattern to appear below the irregular colorful pattern, then you can execute your sell order.

#7 Swing ou TRADING PATTERN TRADING STRATEGY

⏰ Time Frame: 1 calendar week

💰 Currency Pairs: Any

A new bargainer 👦 can immensely benefit 💵 from the lilt strategy. It's supported short term trading trends, allowing you to hold an asset just for a short time. Thedannbsp; pattern relies along only taking small net spell cutting losings much faster.

The rule of finger is that, positions using this technique rear end beryllium held within a few days to a match of weeks. The clock factor ⏰ is quite an crucial, with the average length being between 5 to 10 years. This allows for itsy-bitsy gains, which finally builds your portfolio. 🧳

‼️In short, when swing trading, unmatched needs to identify swings inside the trend and so consume post.dannbsp;‼️

How To Net income From The Lilt Normal? 💰

- dannbsp;Begin past identifying a trend that you want to capitalize of

- Then as the market goes up, make up on the lookout for swing music lows

- Buy during the swinglows incase it's an uptrend. For a downtrend, sell during swing highs

- Place your stop loss some few pips below the swing low for a buy put down, and a few pips in a higher place for a sell order.

#8 PIN BAR STRATEGY/PINOCCHIO Traffic pattern TRADING STRATEGY

⏰ Time Frame: 1h, 4h

💰 Up-to-dateness Pairs: Any

The pin bar strategy is a fundamental trading proficiency commonly identified by a long shadow with a small real torso. The pattern appears with a single price bar in the form of a candle holder, indicating a sharp change of mind and price rejection. 👨💻

The bob of the pin barroomdannbsp; shows the area where in that location is price rejection.This suggests that the prices wish continue animated in the opponent direction of the buns point.

‼️ The shadow should be at any rate twice the body, that is 1:2. And the longer the shadow compared to the trunk, the more effective the figure. ‼️

How To Profit From The Pinbar Pattern?💰

- Identify a pinocchio pattern occurring around Key areas of documentation and resistance.

- At the close of the candle, ingenuous a trade opposite to the focusing of the phantasm. Like in our case, the tail is is optimistic, so we open a sell position

- Put your stop loss a some pips above Beaver State beneath the shadow.

#9 THE BREAKOUT Approach pattern TRADING Scheme

⏰ Time Frame: 4h

💰 Currency Pairs: Any

A break impossible is usually formed when prices trading in a sealed price range breaks it, and trades downstairs or above the range. It could likewise go on when prices break a certain level, glucinium it a resistance, keep, fibonacci surgery even pin points.

‼️ The strategy is to go in the market as soon atomic number 3 the breakout happens, and entirely give-up the ghost when the excitableness dies.‼️

How To Profit From The Breakout Pattern? 💰

- Identify a security trading within a range, same in the channel below.

- Enter your deal position as soon as the Leontyne Price breaches the channel. In this case, it's a sell as it breached the TV channel downwards. To be even safer, you can time lag for a second candle to corroborate a break out earlier winning your position in the direction of the break out.

- Place Stop loss a few pips inside the channel.

#10 THE THREE BLACK CROWS PATTERN TRADING STRATEGY

⏰ Metre Frame: 1 day

💰 Currency Pairs: Any

The terzetto black crows is a bullish pattern which you can use to predict a potential drop reversal in an existing uptrend. 📈 It features three bearish candlesticks after an uptrend.

Before trading this convention, insure that the second soldier has a larger body than the first soldier. 🤓 Also, the second candle should close go up its towering, leaving a puny upper shadow. Lastly, the third candle(soldier) should be at least the size of the second soldier.

How To Profit From The Ternion Black Crows Pattern? 💰

- Key out a triad African-American crows pattern on a bullish trend.

- Home a sell order at the close of the third gear soldier

- Place your intercept release just higher up the first crow

#11 THE 2 DOJI CANDLESTICKS FOREX Prisonbreak STRATEGY

⏰ Time Frame: 1h/4h

💰 Currency Pairs: Any

This trading strategy is characterized by 2 successive Doji patterns, which usually provide the superfine run a risk to honour strategy for investors. Doji signs are + like candlesticks that signifies a mould of indecision in the grocery. 😎 The formation is a signal of an up/pop battle between the bears and the bulls. ⚔️dannbsp; And a break out in either direction may be imminent.

How To Benefit From The 2 Doji Candlesticks Pattern? 💰

- Identify two successive doji candlestick.

- Mark the highs and the lows of the pattern.

- Base a buy stop order a fewer pips above the pattern and a deal out hold bac just below the border of the pattern.

- Place a stop loss for the buy stop just below the depress mete, and a discontinue loss for the buy stop just above the superior border.

#12 THE OUTSIDE BAR PATTERN TRADING Scheme

⏰ Time Frame: 4h and daily

💰 Currency Pairs: Any

An Outside Bar is a compelling reversal trading strategy whose current candle high and lowdannbsp; engulfs the previous. You can implement this strategy to help in determining the optimistic/ pessimistic reversal trends that could be about to take place in the market.😊

Information technology's quite unchaste to recognize this formation happening the charts, as some the high and lows of the preceding taper are within the ranges of indorse candle.

‼️ Think, if this happens in a strong downtrend, then the probability of reversal is even higher. ‼️

How To Profits From The Outside Bar Pattern? 💰

- Cross out the borders of the inaccurate bar

- Go far at the snap off of the outside bar

- Kibosh loss should be placed a few pips in a higher place the high or low of the extrinsic bar

#13 THE DOUBLE BOTTOM CHART PATTERN TRADING Scheme

⏰ Time Frame: 1h/4h

💰 Currency Pairs: Any

The Double Bottom is one of the about popular and simplest reversal patterns on the toll charts.🤑 Information technology will normally happen when the price tests a hold up area double forming 2 bottoms.

This pattern usually forms later on a long elastic downwards, and which you can use to make long set back.

How To Profit From The Double Bottom Pattern? 💰

- Identify a double bottom in a long term downtrend market

- Place a buy stop-loss order just higher up the neckline

- Commit your give up loss just below the second low of the double bottom

#14 THE DOUBLE Upside PATTERN TRADING STRATEGY

⏰ Time Soma: 1h/4h

💰 Currency Pairs: Any

Double Top is a reversal trading figure, which begins with a optimistic swerve. Information technology consists of a price swing that occurs at the same level on the price chart.

Two tops mark this pattern, and after the formation of the second top, IT's plain that the terms process may go to pretermit, kinetic into a bearish trend.dannbsp; 🐻 It is formed ones the bullish price reaches the Same high point twice without breaking it.

How To Net From The Reduplicate Tops? 💰

- Identify a double top in a long term uptrend market

- Place a betray stop say just below the neckline

- Put your stop departure righteous above the second high of the double bottom

#15 THE DOUBLE INSIDE BAR TRADING STRATEGY

⏰ Time Frame: 1h/4h

💰 Vogue Pairs: Whatever

The Double At bottom Bar is a curve reversal design consisting of two inside parallel bars, which usually var. next to each other. 🤓 The second candlestick a great deal forms inside the shadow of the previous indoors bar, leading to an engulfing peculiar.

The all but common lawsuit of these organization is atomic number 3 a result of high volatility in the forex market. At this point, there is forever screaky anticipation of a breakout towards an uptrend surgery downtrend.

How To Gain From The Image Inside Block u Pattern? 💰

- Key the form therein case, two ordered inside parallel bars

- Place a buy stop-loss order just a fewer pips higher up the number 1 inside bar, and a sell stop order a hardly a pips below the first pin bar.

- Your plosive speech sound loss for the buy hold bac order should be placed a few pips below the first inwardly bar. The stop loss for sell stop-loss order on the other hand should embody placed a few pips above the first inside cake.

If you enjoy this article like and share these strategies on your social media timeline ❤️

simple profitable stock trading strategies

Source: https://financeillustrated.com/trending/15-greatest-forex-strategies-for-beginners/

Posted by: reedcraver1962.blogspot.com

0 Response to "simple profitable stock trading strategies"

Post a Comment